Building Value with Passionate Entrepreneurs

dedicated to partnering with ambitious

entrepreneurs and transforming their ventures.

By leveraging our industry knowledge, financial acumen and operational expertise, we identify and nurture investment opportunities that create sustainable growth and value.

Strategy

Stakeboat’s dedicated team collaborates with entrepreneurs and companies to address their growth capital requirements through a disciplined approach.

Mid-Market Growth Capital

We focus on investing in emerging stars in the startup and MSME sectors with high potential for growth and profitability.

Strategic Control and Co-Control

We engage in control, co-control and significant minority investments, empowering companies to expand their operations and improve profitability through strategic guidance.

Supporting Organic Growth

We support scalable platforms to facilitate organic growth, helping businesses expand their market presence effectively.

Transforming Fixable Flaws

We explore white spaces as areas of potential growth and profitability and identify companies with fixable flaws—structural and operational inefficiencies. By addressing these challenges, we help businesses evolve, scale and unlock their true potential.

Complimenting Growth through Acquisitions

Our strategy includes acquiring complementary businesses to enhance inorganic growth and boost the overall value of our portfolio companies.

Scaling with Leadership

We emphasize strengthening management teams, including CXOs and key leadership roles, to drive execution and scalability. By bringing in the right talent and implementing professional management practices, we help businesses transition from a pure founder-led operations to professionally managed organizations, ensuring sustained success and resilience in a dynamic market.

Collaboration

Stakeboat Capital’s extensive operational expertise and network provides access to benchmarks, learnings and expertise , enabling informed investment, expansion and divestment decisions.

Operational Expertise

We provide comprehensive strategic guidance including digital transformation, leadership development and operational excellence, streamlining operations to enhance efficiency and profitability.

Strategic Growth Plan

We work with entrepreneurs to develop and implement strategic growth plans that include geographic and product expansion, as well as cost optimization, ensuring hands-on support and collaboration.

Systems and Processes

We strengthen systems, controls and governance processes, actively participating in enhancing our portfolio companies to help them achieve global standards.

Sectors

We focus on asset-light models in high-growth sectors, identifying opportunities where we can drive significant value.

& Pharma

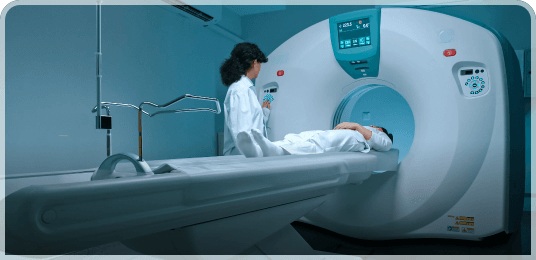

Healthcare Delivery:

We back ventures in single-specialty, multi-specialty hospital setups and allied services, driving growth through strategic expansion and operational excellence.

Medical Equipment & Consumables:

We invest in businesses that manufacture and supply medical equipment and consumables, ensuring high-quality, cost-effective solutions for the healthcare ecosystem.

Outsourced Healthcare Tech Services:

Technology-driven healthcare solutions are transforming the industry, creating opportunities for innovation and efficiency. We support businesses specializing in healthcare IT, diagnostics, telemedicine, and digital health services, enabling them to scale operations and enhance technological capabilities.

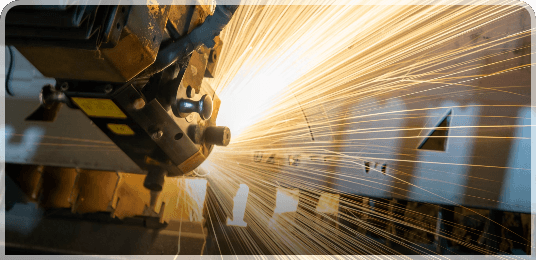

& Manufacturing

Market Leaders:

Backing businesses with strong EBITDA margins and differentiated customer value propositions that drive long-term success.

Recurring Demand:

Investing in products with consistent market demand and high growth potential, ensuring stability and scalability.

Diverse Networks:

Supporting firms with well-diversified customer and supplier bases, reducing dependency risks and enhancing resilience.

& Business Services

Enabling Market Leadership:

Partnering with software and IT companies that redefine their sectors through technology, compelling customer value propositions, process excellence and strong financial performance.

Building Differentiation:

Backing businesses that create competitive moats through innovation, automation, competitive advantage and recurring revenue models.

Scaling for the Future:

Supporting companies in expanding their reach, optimizing operations, sustainable expansion and driving digital transformation for long-term success.

Themes

Our investments are guided by themes that ensure we partner with businesses poised for impactful growth.

Scalable Models

We emphasise investing in businesses that are ready to scale and have demonstrated the potential for significant expansion.

Competitive Advantage

We strategically invest in companies that possess a unique market position or edge.

Passionate Entrepreneurs

We strengthen systems, controls and governance processes, actively participating in enhancing our portfolio companies to help them achieve global standards.

Active Business Partnership

We foster a collaborative environment that supports strategic and operational growth, ensuring a proactive and engaged partnership from initial screening through to exit.

Exits

Stakeboat Capital maintains a proactive focus on exits, guided by a well-defined philosophy and roadmap aimed at optimising returnsand achieving liquidity for our investors.

Timely Decisions

We focus on making well-timed and informed exit decisions that align with our investment objectives, ensuring strategic exits within the targeted time frame.

Strategic Sale, Secondary Sale, Public Listing

Our exit strategies include strategic sales, secondary sales or public listings, designed to maximise value for our Limited Partners over a 4–5 year time frame.